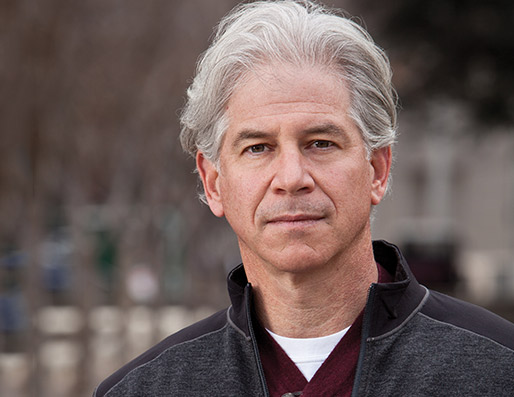

“You can follow all the rules and still commit fraud and that’s what I did at Enron,” said Andrew Fastow, former Enron CFO and convicted fraudster*, at the 2015 ACFE Asia-Pacific Fraud Conference. “I followed the rules — but undermined the principle of the rule by finding the loophole.”

Fastow told a packed room of attendees that he became the master at gaming the system, explaining that his title at Enron should have been “chief loophole officer.” By creating structured financing transactions that kept debts off-the-balance sheets, Fastow made the company appear healthier than it actually was.

Holding up his trophy for CFO of the Year in 2000 and then subsequently showing his prison ID, Fastow said, “I got this trophy and this prison ID for doing the same deals.” He explained that a CFO can fundamentally change how a company looks, but that doesn’t change the economic standings of the company, which is incredibly misleading.

But his message went beyond the Enron scandal. Fastow explained that what he did is still being done today, and in a bigger way. Referring to it as the “grey area” of accounting, he stated that “there are over $1 trillion off-the-balance-sheet operating leases in the U.S.” — and banks are some of the largest culprits. While these entities might be following the rules, are they considering the ethical implications of each deal?

“If your role today as fraud examiners is to make sure companies are following the rules, you’re not detecting fraud,” said Fastow. “It’s not just the rules, it’s the principles too. I focused just on the rules and that was my mistake.”

Ultimately, Fastow’s mistake caused irrepreparable damage at Enron. “What I did was wrong and it was illegal and for that I’m very sorry, very remorseful. I wish I could undo it,” he said. “But I’m trying to explain how someone who didn’t necessarily set out to commit fraud or do harm could come to do that and on such a grand scale.”

Other Speakers Cover Money Laundering, the FIFA Scandal and More

While Fastow’s presentation allowed attendees to look into the mind of a fraudster, other featured keynoters and breakout sessions provided tools and techniques to help anti-fraud professionals enhance their fraud-fighting skills.

Jonathan Davison, Chief Executive Officer of Forensic Interview Solutions, kicked the conference off in his Pre-Conference session, Managing Internal Investigations. He asked attendees to look at their investigation as a product and took them through the stages of an internal investigation, from planning, to evidence collection and analysis, and finally to effective report writing.

On day two, James D. Ratley, CFE, President and CEO of the ACFE, opened the main conference by welcoming attendees and speaking about the state of the ACFE and the anti-fraud profession. Ratley encouraged attendees to embrace technology and data analytics. “When the ACFE was founded in 1988, the life of the Certified Fraud Examiner was not as complicated as it is today,” said Ratley. “The computer was still in limited use, and we were just beginning to hear a new term: ‘the Internet’. There was also a new device sitting on people’s desk called the fax machine. Little did we know how technology was about to change our profession.” In order to embrace the changes of the future, he stressed the importance of continuing education and to always remember that knowledge is power.

In one of the first breakout sessions of the day, Jarrod Baker, ACA, Senior Managing Director at FTI Consulting, discussed the recent arrests of numerous FIFA officials for racketeering, fraud and money laundering, and the subsequent resignation of FIFA president Sepp Blatter. Baker then covered lessons anti-fraud professionals could take from the FIFA scandal, including:

- A company cannot use the pretense of charitable contributions as a way to funnel bribes

- Bribery laws can be breached even if the purpose of the payment is not achieved

- You can be subject to international laws based on your conduct, and there is increasing cooperation between international authorities

During lunch, Gunawan Husin, MBCI, CBCP, CAMS, Principal Consultant at Continuum Asia PTE Ltd, spoke to attendees about fraud as a predicate act to money laundering and terrorist financing. “I’m going to mainly be talking about money laundering today, but I don’t want to downplay fraud prevention,” said Husin. “Fraud is key. You need to look at the bigger picture.”

Husin then showed a video that highlighted how money changes hands from institutions to criminals and back again and asked attendees, “Are we doing the right thing as a sector? Are we doing what we are supposed to do to safeguard our institution and community?” He asked people to raise their hands if they’d like to do business with criminals. Not a single hand shot up. “No one wants to do business with criminals? Well what do the statistics say?” he continued. “We’re still doing business with bad guys. They’re still abusing your systems.”

A spirited panel discussion moderated by Roger Darvall-Stevens, CFE, Partner, National Head of Forensic Services, RSM, closed out the final day of the conference. Panelists included Tony Prior, CFE, CAMS, Director, Ernst & Young LLP; Rachael Mah, CA, CPA, PMIIA, Managing Director, AusAsia Training Institute Pty Ltd; and Simon Goddard, CFE, Managing Director, Global Insight Ltd. These international anti-fraud professionals discussed best practices to use when a fraud extends beyond a country’s borders and how to keep on the right side of the law while conducting fraud investigations.

"A pragmatic approach to cross-border or international interactions is necessary as there are many pitfalls of which to be aware to make your fraud examination a success," said Darvall-Stevens. "Understanding the local culture and laws is also essential to ensure that you as fraud examiners don't inadvertently contravene laws or disrespect cultural nuances which is likely to inhibit fact-gathering investigations and anti-fraud work."

As we wrap up another successful ACFE Asia-Pacific Fraud Conference, we look forward to putting on more regional conferences across the globe in 2016: the Middle East Fraud Conference in Dubai (February 14-15), the European Fraud Conference in Brussels (March 20-22) and the Canadian Fraud Conference in Montreal (September 11-14). We hope to see you at one of these events! (Learn more at ACFE.com/Conferences.)

*The ACFE does not compensate convicted fraudsters.