4 Ways to Increase Your Level of Management Review in 2015

/GUEST BLOGGER

Jeremy Clopton, CFE, CPA, ACDA

Senior Managing Consultant, Forensic and Valuation Services, BKD, LLP

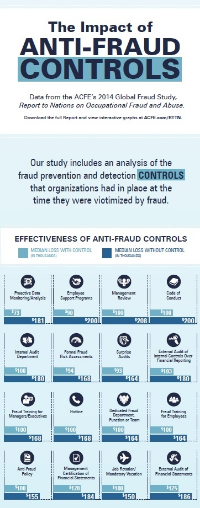

February is here. We've made it past the excitement of the new year, made (and perhaps broken) a few resolutions and undoubtedly read a few different “new year, new you” articles. Now it is time to get down to business: the prior year’s books need to be closed, current year operations are kicking into high gear and you may be conducting your first management review of the 2014 financials. In fact, according to the 2014 Report to the Nations, nearly half of the organizations surveyed did not use management review as an anti-fraud control. This is especially true for smaller organizations, where only one-third of organizations used management review as a control.

Interestingly, of the anti-fraud controls listed, management review is likely one of the easiest and most cost-effective controls to implement in a small business. And, given that small businesses are often owner-managed, there should be a keen interest in conducting such a review. Though, as with any control, figuring out how to get started is sometimes the most difficult. With that, here are four ways to increase your level of management review in 2015:

- Obtain and review your bank statements. It is important to obtain a copy of your bank statements directly from the bank each month, including the cancelled check images. Some of the most common fraud schemes in the Report to the Nations are disbursement related — meaning money is going out the door. Generally, that activity is captured in the bank statements. Easy-to-spot items, such as unusual electronic payments, credit cards your organization doesn't have, checks payable to employees or manual checks in a batch of electronic payments can make this review both effective and efficient. If small business owners logged onto their bank’s website once a week to look at the transactions, it would keep many frauds from growing into a much bigger problem.

- Take advantage of your ratios. Ratios were meant to be compared. That might not be the true reason they were created, but it is one of the most effective ways to use them for management review. Comparing your key ratios over time (monthly, quarterly, annually, etc.) to peers in the industry or to other benchmark data provides insights into how your business is performing. While they might not be enough to facilitate operational decision-making, these simple comparisons provide indications of change within the financials.

- Obtain electronic data and verify the reports you are provided for review. Management likely receives and reviews reports each day. These reports, however, may be a slight variation on what the data actually says. Therefore, it is important to obtain the underlying data for your standard reports and review the two for consistency. If the reports come directly from accounting, go directly to IT to obtain the data. Getting these items from different sources provides you a means to verify the contents of your regularly reviewed reports. For example, an accounts receivable aging report might not show a significant number of outstanding balances. A review of accounts receivable transaction data, however, shows a large number of write-offs. The review of the underlying data provides a better understanding of the report and may lead to additional questions.

- Embrace the dashboard. No, I don’t mean go out and give your car a hug. Rather, enlist the help of someone in the IT department or internal audit department to leverage all of that “big data” your organization is generating. Aggregating the detailed data elements into a high-level dashboard can allow you to efficiently perform a management review of key metrics, controls and other items of interest. For example, if vendor management is a concern in your organization (hint: it probably should be), incorporate statistics about new vendors, vendor changes and dormant vendors in your dashboard. You might need dashboards for each business process or operating division. Dashboards allow you to have greater insight into the data without being overwhelmed by millions of data points.

As you continue your review of the 2014 results, begin to review 2015 results now. Management review is not only an effective anti-fraud control; it is also a way to provide you greater insight into the operations of the organizations you manage.