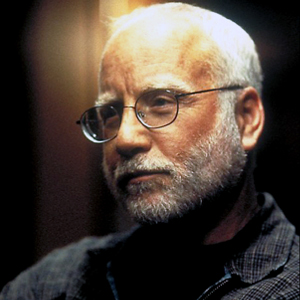

Fraud Fighters to Hear From Actor Richard Dreyfuss, U.S. District Judge and More

/GUEST BLOGGER

Sarah Hofmann

ACFE Public Relations Specialist

Academy Award-Winning Actor Richard Dreyfuss, Judge Jed S. Rakoff, New York Times investigative journalist David Barboza and other experts will address more than 3,000 anti-fraud professionals gathering for the 27th Annual Association of Certified Fraud Examiners (ACFE) Global Fraud Conference in Las Vegas, June 12-17.

Most recently acclaimed for his portrayal of notorious fraudster Bernie Madoff in ABC’s miniseries Madoff, Dreyfuss immersed himself in the role. On portraying the ringleader of the $18 billion Ponzi scheme that would bankrupt hundreds of people and organizations, he said, “I’ve never played such a vivid and living legend of monstrosity … His ability to inflict pain on others was unbelievable.” Dreyfuss is not only known for his acting, but for his political and social activism as well.

Judge Jed S. Rakoff, U.S. District Judge of the Southern District of New York, has made a name for himself rejecting Securities and Exchange Commission settlements with big banks and fighting for the Department of Justice to crack down on fraud, specifically suggesting individual executives should be held accountable in lieu of the corporation as a whole. In an interview with Fraud Magazine, he explained, “While the government never approved fraud per se, it helped create some of the conditions that invited fraud.”

Other keynote speakers include New York Times investigative journalist and author David Barboza, body language expert Steve van Aperen and Halliburton whistleblower Anthony Menendez, CFE, CPA. Convicted fraudster Roomy Khan, who was involved in the Galleon Group insider trading scandal, will also address attendees. She will speak without receiving compensation from the ACFE.

The conference is the world’s largest gathering of fraud fighters and will feature more than 80 educational sessions presented by top experts in the anti-fraud field. Educational sessions will focus on subjects including cyberfraud and cybersecurity, white-collar crime, anti-bribery and anti-corruption practices, risk management, and fraud detection and prevention.

Don’t miss your chance to hear from experts on today’s most pressing fraud and corruption issues. Visit FraudConference.com for more information, video clips, articles and live updates from the conference.