Episode Notes for Fraud Talk Podcast: Mailing Madoff

/GUEST BLOGGER

Sarah Hofmann

ACFE Public Information Officer

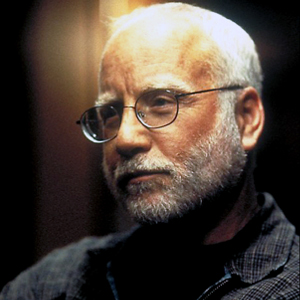

When you think of pen pals, you usually think of kids staying in touch after friendships forged at summer camp. In stark contrast of that sunny scene, for David Weber, J.D., CFE, his pen pal was the result of a U.S. Securities and Exchange Commission (SEC) investigation. Weber, academic director of fraud management programs at the Smith School of Business at the University of Maryland, regularly corresponds with infamous fraudster Bernie Madoff.

In the latest episode of Fraud Talk, Weber describes how the two first crossed paths when Weber was working as the assistant inspector general for the SEC and directed the reporting of misconduct in the Madoff case. After leaving the SEC, and becoming a professor, Weber received an email from none other than Madoff. The two began talking on a regular basis and Madoff even answers questions posed by Weber’s students. “He’s very direct in the emails; he’s not a man that minces words,” Weber said. “He really does express remorse, and he does continue to be of the view, and I agree with him, that the regulatory agencies really failed to do their jobs.”

His close relationship with a man who cheated hundreds of people and organizations out of billions may raise eyebrows, but Weber believes there is more to be gained from talking to convicted fraudsters than refusing to on hear their stories.

“There’s no question that we can learn from fraudsters,” he said. “As fraud fighters, we are frequently in a position where clearly being proactive is part of our role, but in many cases, when there is spectacular fraud, we are not learning of the fraud until the incident has finally occurred. We are part of the response team.”

Weber likened investigating fraud to coming to the scene of a car crash after the fact. “There are injured people, there are people who need to be triaged, there are cars that are damaged, there is debris in the road,” he said. “Many times, it’s hard to figure out through the victims what transpired, so having any person on the scene who is still able to speak is helpful, even if they were a drunk driver. Even if they were somebody who drove recklessly, hearing what they have to say is very important to reconstructing the scene.”

Weber acknowledges that hearing from fraudsters may be controversial, as anti-fraud professionals understandably don’t want to glamourize their actions. “I have been at the fraud conference many times where I have heard some of these convicted felons speak … and I agree it can put some of them on a pedestal,” he said. “But anything we can get from these people to help us reconstruct the scene, and build a better mousetrap in the future — we should embrace the ability to speak to them.”

To hear more from Weber, register for the 28th Annual ACFE Global Fraud Conference June 18-23 in Nashville where he will be teaching a session on the Panama Papers.