Kozlowski's $6,000 Shower Curtain Added to the ACFE Fraud Museum

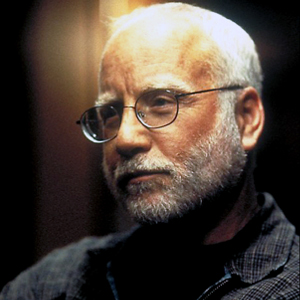

/Dennis Lynch, former Tyco VP and Chief Litigation Counsel, delivers the infamous shower curtain to ACFE Chief Operations Officer Jeanette LeVie.

AUTHOR'S POST

Mandy Moody, CFE

Content Manager

Corporate greed at the executive level has destroyed hundreds of companies, drained stockholders of their investments and left innocent employees without work. Ken Lay, Jeffrey Skilling, and Andrew Fastow from Enron; Bernie Ebbers from MCI/WorldCom; and Dennis Kozlowski at Tyco have become household names, and too many exemplify what can go horribly wrong when the tone at the top goes askew.

Dubbed the “archetype of avarice” by The New York Times, Kozlowski could have written the book on how NOT to set an ethical tone at the top. This gold and burgundy shower curtain, which was hung in his maid’s bathroom at his residence on 5th Avenue in New York, was reported to cost more than $6,000.

However, his lavish lifestyle did not stop at bathroom décor. In 2001, he reportedly threw a $2 million Roman-themed party for his second wife’s birthday in Sardinia. According to the Times, Jimmy Buffet played the guitar and an ice sculpture of David was displayed urinating Stolichnaya vodka. He owned impressionist paintings and a 130-foot yacht that was originally built for the 1934 American Cup.

His empire came crashing down when he was indicted for tax evasion on a $14 million piece of artwork. This led to a larger internal investigation into his business practices at Tyco. In 2005, Kozlowski was convicted of stealing nearly $100 million from Tyco and was sentenced to a maximum of 25 years in prison. He served the minimum sentence of eight and a half years, and was released in 2014.

You can view the shower curtain in all its glory at the upcoming ACFE Global Fraud Conference in Nashville, June 18-23, in the Traveling Fraud Museum Exhibit. Remember, you can still save $100 if you register by May 10!