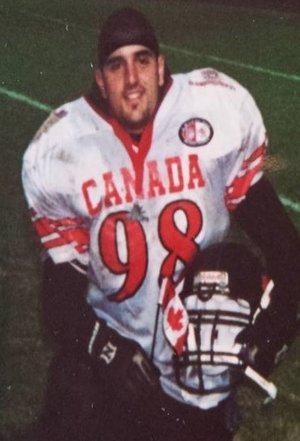

MEMBER PROFILE

Pierre-Luc Pomerleau, CFE, PCI, CPP, has been in the anti-fraud field his entire professional career. Last year he helped establish the Montreal Chapter and has already made a big impact on the community by organizing sold-out events, establishing networking opportunities and helping promote the largest ACFE Fraud Conference Canada.

What do you do for a living?

I lead National Bank of Canada’s Corporate Security and Fraud Risk Management Division, which includes corporate security investigations, physical security, and the fraud strategy and data analytics teams.

Why did you decide to enter the anti-fraud field?

I entered the anti-fraud field almost 12 years ago when I was finishing my bachelor’s degree in criminology. I had the opportunity to work part-time as a fraud prevention analyst within a large Canadian financial institution. It was the perfect job for me at that time since the job was related to my degree. At the time, I never thought that I would work in a financial institution. However, since the beginning of my career, I’ve always worked in this industry.

How long have you been involved with the chapter?

I have been the president of the new Montreal Chapter since its formation in October of 2015.

What has been a highlight during your time on the board?

Since March is Fraud Prevention Month in Canada, we felt it was important for us to organize an event to promote fraud awareness. We organized a full-day training event and it was a huge success. A total of 185 anti-fraud professionals attended. We did a survey after the conference and the feedback we received from our members was excellent. Since it was our first full-day event, we did not know how many members would attend and we were glad that it was a sold-out event.

Do you have any advice for other chapter leaders?

A board is like a team. The most important things while investing time in a nonprofit organization are your peers and colleagues on the board. It takes time and a lot of organizational skills to build a website, prepare training, get interesting speakers to present at conferences and sponsors to fund our conferences, as well as to find a location for the members to assist an event while working full-time jobs. Having a dedicated board will ensure volunteering for the chapter will be an amazing and beneficial experience.

I strongly believe it is imperative that chapter leaders share roles and responsibilities between each other and that not only a couple of members do the work that needs to be done. We clarified roles and responsibilities between us and we hold ourselves accountable. I believe that this is the best way to invest time and energy in order to create value for the chapter and its members.