The Most Effective Controls in Limiting Fraud Losses

/ GUEST BLOGGER

GUEST BLOGGER

John Warren, J.D., CFE

ACFE Vice President and General Counsel

One of the most important things we try to accomplish with our global fraud study, the Report to the Nations, is to identify key characteristics about organizations that have been victimized by occupational fraud. Although every business is vulnerable to fraud, the more we can learn about organizations that suffered frauds in the past, the more information we will have to prevent occupational fraud or at least limit its impact in the future.

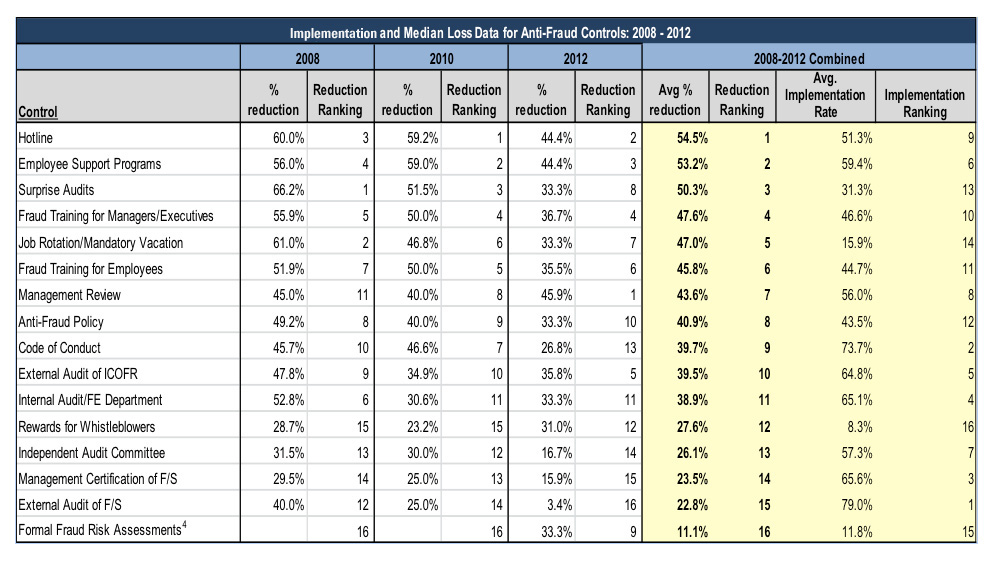

Perhaps the most important victim data contained in the Report to the Nations is the information we gather on anti-fraud controls. We ask each of our respondents to tell us which, if any, of 16 common anti-fraud measures were utilized by the victim organizations while the frauds were occurring. We then compare the losses based on whether a particular control was or was not present. For example, in 2012 we found organizations that used a hotline experienced a median loss of $100,000 per occupational fraud case, while organizations that did not use a hotline had a median loss of $180,000. This analysis gives us a general indication of the impact various anti-fraud controls have in limiting fraud losses. We can say, for instance, that the presence of a hotline was associated with a 44.4 percent lower median fraud loss.

In the table below, we’ve presented the results of this analysis for each edition of the Report to the Nations dating back to 2008. For each anti-fraud measure, you can see the reduction in fraud losses it was associated with, along with its ranking relative to other controls.[1]One interesting thing to note is that every one of these controls was associated with lower fraud losses in all three editions of the Report.

The key information in this table is contained in the yellow shaded columns at the right, where we have combined the results from all three editions of the Report. This data comprises more than 4,100 total cases of occupational fraud. The two bold columns show the average loss reduction and overall ranking of each control for the three combined studies. We see here that hotlines have ranked No.1 among all anti-fraud measures in this analysis, typically being associated with a 54.5 percent reduction in fraud losses. Hotlines were followed by employee support programs, surprise audits, fraud training for managers and executives, job rotation/mandatory vacation, and fraud training for employees. Every one of those six anti-fraud controls was associated with at least a 45 percent reduction in fraud losses, and all six controls ranked in the top 8, respectively, in each edition of the Report.

The key information in this table is contained in the yellow shaded columns at the right, where we have combined the results from all three editions of the Report. This data comprises more than 4,100 total cases of occupational fraud. The two bold columns show the average loss reduction and overall ranking of each control for the three combined studies. We see here that hotlines have ranked No.1 among all anti-fraud measures in this analysis, typically being associated with a 54.5 percent reduction in fraud losses. Hotlines were followed by employee support programs, surprise audits, fraud training for managers and executives, job rotation/mandatory vacation, and fraud training for employees. Every one of those six anti-fraud controls was associated with at least a 45 percent reduction in fraud losses, and all six controls ranked in the top 8, respectively, in each edition of the Report.

In the two far-right columns of the table above, we have presented the average rate of implementation for each control. In other words, this shows what percentage of victim organizations were utilizing each control at the time the frauds occurred. We can clearly see that the six most effective anti-fraud measures all scored poorly in terms of implementation. With one exception, these controls all ranked 9th or lower in terms of implantation rate, and only two of them were used by more than half of the organizations in our studies.

What this data seems to indicate is that the anti-fraud measures which tend to have the greatest impact on fraud losses are being under-utilized. Every control in the table above is important and they all have an impact not only in limiting fraud losses but also in preventing them. But the six highest ranking anti-fraud controls, according to our study, are utilized by an unacceptably low number of companies and agencies.

Every organization is, at some point, vulnerable to occupational fraud. Ideally we would prevent all such frauds from ever occurring, but sooner or later a fraud will occur, and when it does, the best thing we can do is catch it as quickly as possible and limit the financial impact of the crime. We hope organizations that are serious about reducing their exposure to occupational fraud will consider this data and in future studies we will see the implementation rates for hotlines, support programs, surprise audits, fraud training and job rotation increase substantially.

[1] “Formal Fraud Risk Assessments” was not a category prior to the 2012 Report.