Which Anti-fraud Controls Provide the Best Bang for Your Buck?

/GUEST BLOGGER

Andi McNeal, CFE, CPA

ACFE Research Director

During International Fraud Awareness Week (Fraud Week), hundreds of organizations worldwide join together to promote the importance of fraud detection, deterrence and investigation. The proactive approach these organizations take to fighting fraud is notable, and it sends a clear message to their employees and the public — as well as to potential perpetrators — that management is serious about protecting the company from fraud.

As part of Fraud Week (and throughout the rest of the year), we encourage companies to examine their internal controls and assess whether they are effectively designed and operating to combat fraud. While undertaking this type of assessment, one of management’s most common concerns is whether the organization’s anti-fraud resources are invested in the most cost-efficient and effective preventive and detective controls. So how can organizations know which anti-fraud controls provide the best bang for their buck?

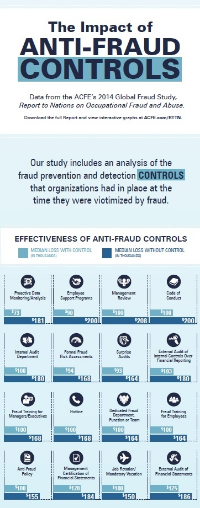

The ACFE’s 2014 Report to the Nations on Occupational Fraud and Abuse includes information that can help organizations gain insight into the answer to that question. And to highlight our findings in a way that we hope helps in making informed decisions about how to most effectively spend anti-fraud dollars, we also created an infographic on the impact of anti-fraud controls.

As part of our research, we examined the controls that were — and were not — in place at organizations victimized by fraud. This allowed us to identify trends that reflect the potential effectiveness of various anti-fraud controls, such as:

- Organizations that engaged in proactive data monitoring and analysis suffered fraud losses that were approximately 60 percent smaller than organizations that did not.

- Other controls associated with noteworthy reductions in median losses include employee support programs (such as addiction, family or financial counseling), formal management review procedures and a written code of conduct.

- Although tips are consistently the most common means by which frauds are detected, only 54 percent of the victim organizations in our study had a formal hotline in place at the time of the fraud, meaning nearly half of the companies were not optimally poised to detect the schemes at their organizations.

- External audits are widely used — 81 percent of victim organizations underwent financial statement audits at the time the frauds occurred — and they serve many useful purposes. However, these audits were responsible for uncovering just 3 percent of the frauds in our study, reflecting the need for organizations to not rely exclusively on this control as the primary means of fraud detection.

Our data also reinforces what so many anti-fraud professionals and small business owners inherently know — that small businesses are uniquely and particularly at risk for fraud. Across the board, small businesses have a much lower implementation rate of anti-fraud controls than larger organizations, which leaves them especially vulnerable to being victimized by dishonest employees.

International Fraud Awareness Week is a great time for anti-fraud professionals to download the infographic on the impact of anti-fraud controls and the full ACFE 2014 Report to the Nations, and to use these resources to educate and encourage managers and business owners about the need for wisely investing in fraud prevention and detection controls.